The 7-Second Trick For What Causes Foundation Problems

Wiki Article

What Does What Causes Foundation Problems Do?

Table of ContentsThe Single Strategy To Use For What Causes Foundation ProblemsGetting The What Causes Foundation Problems To WorkEverything about What Causes Foundation ProblemsAn Unbiased View of What Causes Foundation ProblemsWhat Causes Foundation Problems Can Be Fun For Anyone

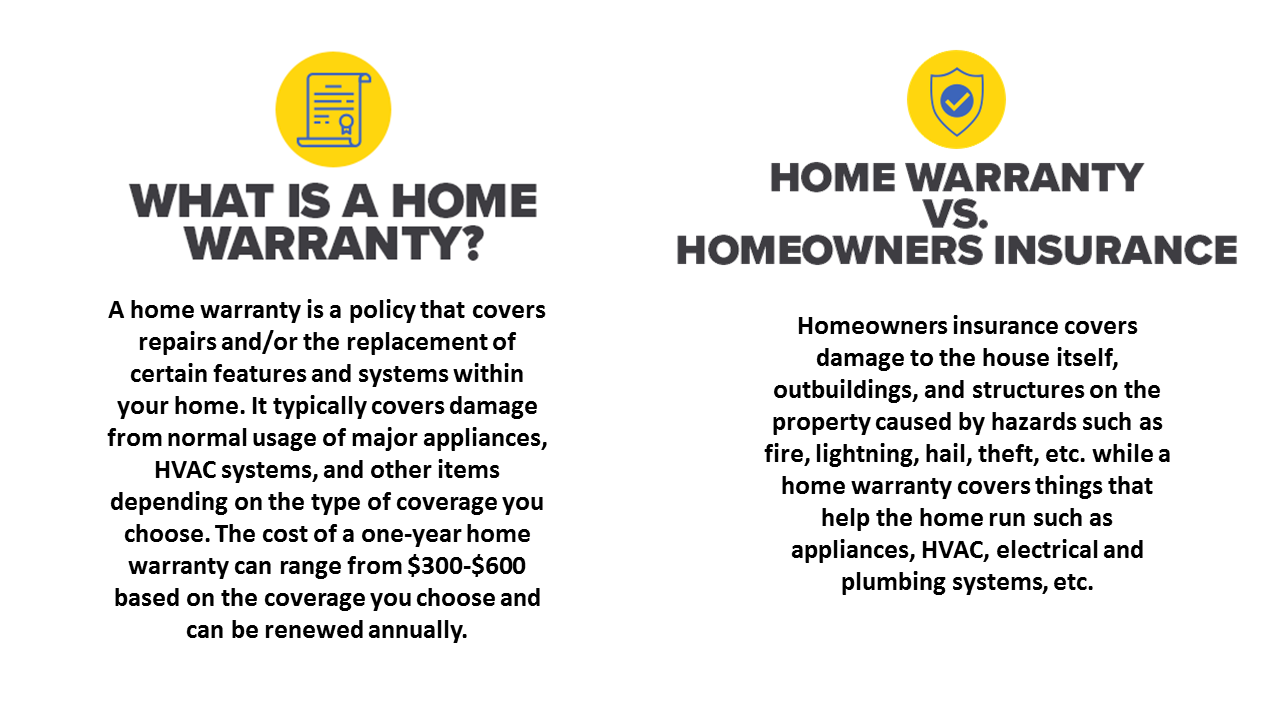

A residence guarantee functions as comfort. Home warranties are likewise excellent for people that aren't handy or do not desire to fret about tracking down a specialist when they have a trouble with any of the home appliances covered in the guarantee. If you are somebody with pricey taste when it comes to electronic devices and also home appliances, a home guarantee is the most effective for you.A warranty can also be practical to individuals who have actually just utilized their savings to buy a house and also wish to stay clear of any type of extra significant expenditures. If you are a residence vendor, providing a purchaser a paid-up, one-year home guarantee with the purchase might provide an action of defense in the occasion the purchaser grumbles regarding any type of uncovered problems or defects that arise after the sale closes.

What after that is residence insurance policy? Can it complete with the advantages supplied by a residence warranty? Home insurance coverage is a kind of residential or commercial property insurance that covers or protects you financially in the event of unforeseen losses as well as damages to your residence, including furnishings as well as various other things in the residence.

An exception to this policy is any kind of event that has impacted your capability to remain in the residence or the protection of your building. When it comes to renewing or taking out home insurance policy, some insurers will certainly additionally ask concerning any kind of losses that can have led to a case, even if you really did not seek one.

The Main Principles Of What Causes Foundation Problems

Claims may be denied if it is discovered that this is not the case, primarily when storms harm the roofs. You ought to inspect your roof every few years and also make certain that it is intact. Many insurers will certainly provide you as much as 180 days to claim from your residence insurance policy, but it's always a good idea to obtain in touch with insurers immediately.

Likewise, you can decide to acquire an extra policy that covers and also safeguards the components of your house like your furniture, electronic devices, and also beneficial home devices. If your residence is guaranteed, you will certainly have monetary safety. This features the included advantage of repairing any kind of damages to your residence that is covered by the insurance coverage.

Natural disasters are every property owner's problem. We do not see them coming, and usually, we can do little or nothing to quit their effect on our homes. The consequences of using up the expense of repairing a harmed residence is not the kind of burden home owners intend to place on themselves as well as their family members, specifically when they are attempting to get over the emotions that feature the damages.

The Single Strategy To Use For What Causes Foundation Problems

House insurance policy is not costly, although navigate to these guys a house insurance policy could look really costly and you may not wish to incur any type of unwanted cost. When you take a great take a look at the advantages offered under a residence insurance policy system, you will see that the advantages are much even more than money can buy.In addition, if your policy also covers the components of your residence, you will certainly pay even more but will certainly acquire much more ultimately. Based upon the kind of policy you have, you and your household will be shielded in the occasion of property-related claims. Your house insurance coverage will certainly provide defense if you or any kind of participant of your family mistakenly damage an additional property, like in the case of a fire or mechanical damage.

Guaranteeing your residence offers you with the ultimate luxury of tranquility of mind. Both the home guarantee contract and home insurance coverage plan work in a similar way.

What really sets apart a house guarantee contract from a home insurance plan? The significant distinctions between a house warranty and also home insurance policy is the coverage.

The Main Principles Of What Causes Foundation Problems

A home guarantee might additionally cover major home appliances, such as washing machines as well as dryers, fridges, and also swimming pools. Normally, property owners, especially those in Idaho, are called for to have a house insurance plan for their homes if their residences are mortgaged. A home warranty strategy, as a matter of fact, is not called for. It is optional.

House insurance coverage can help you lower the cost of fixings if your residence framework is harmed, while the cost of repairing damages done to your residence by malfunctioning systems or home appliances can be decreased by a residence guarantee. Therefore, these two options you can check here job well with each other to shield every component of your brand-new home.

Our team of specialists will certainly examine the alternatives offered to you and also send wikipedia reference you a quote.

When there's a failing, you simply contact HSASM as well as they'll send off a qualified home repair work expert to take treatment of you. Buyer Conveniences There can be several costs to cover when relocating into a new residence. Bask in understanding that repair services to a covered system or home appliance will not be one of them.

The Only Guide for What Causes Foundation Problems

About Fidelity House Guarantee For over 25 years, Integrity National House Warranty has actually given homeowners with the satisfaction that their residence is protected from unexpected major expenses. Beginning as Partnership House Guarantee in 1995 and also complying with a series of purchases, including Chicago House Service warranty, the firm combined under the Integrity umbrella in 2001.

Integrity National Residence Service warranty uses competitive home warranty quotes as well as coverage, yet their largest differentiator is their relentless dedication to client solution. Their goal is to protect homeowners and their largest investment homes and also the valuables in it as well as they do it by supplying affordable house guarantee pricing at a price saving to customers, and they do it without jeopardizing protection - what causes foundation problems.

What Does a Fidelity National Residence Warranty Strategy Cover? With an one-year Standard and Comprehensive Plus home protection plan by Integrity, house owners are covered for significant systems and also home appliances past what simply standard property owner's insurance policy will certainly cover. For the vast bulk, the residence is the single greatest financial investment that people will make.

Report this wiki page